We Turn Agentic AI and Digital Transformation into a Strategic Lever for Major Insurers.

CustomApp helps insurers onboard faster, automate workflows and connect teams at scale, improving customer experience, reducing risk and accelerating claims and service delivery.

Stop Solving Everything.

Start Solving What Hurts Most.

Where in the value chain is the friction? From FNOL to final invoice, our platforms connect brokers, assessors, suppliers and clients. So claims move faster, with fewer handoff errors.

Manual Insurance Claims

Slow processing → high costs → errors → dissatisfied customers → lost renewals

Disconnected Broker Portals

Siloed data → no single source of truth → poor decisions → intake errors → slow update

Playing Catch-up with Compliance

Changing regulations → manual checks → audit risks → fines → stalled operations

Miles Away from Leveraging AI

Outdated architecture → no AI-driven insights → missed fraud detection → slower claims → lost advantage

Still Using Desktop-Based or Siloed Platforms

Old PAS or admin tools → not built for omni-channel intake, automated triage, or supplier integration → more manual effort, less agility

Off-the-Shelf Solutions That Don’t Scale with You

Generic claims or CRM tools → rigid workflows, limited scheme flexibility → poor broker adoption and rising leakage over time

Award-Winning Solutions

Long-Term Partnerships

Proud Member

+27yrs industry experience, 200 employees across 4 continents

Where Must You Succeed with Transformation?

Field data →

- Make claims, data capture and field assessments faster and easier

- Get accurate, reliable data right at the point of loss

- Stay compliant with regulatory requirements while collecting data on-site

Back office →

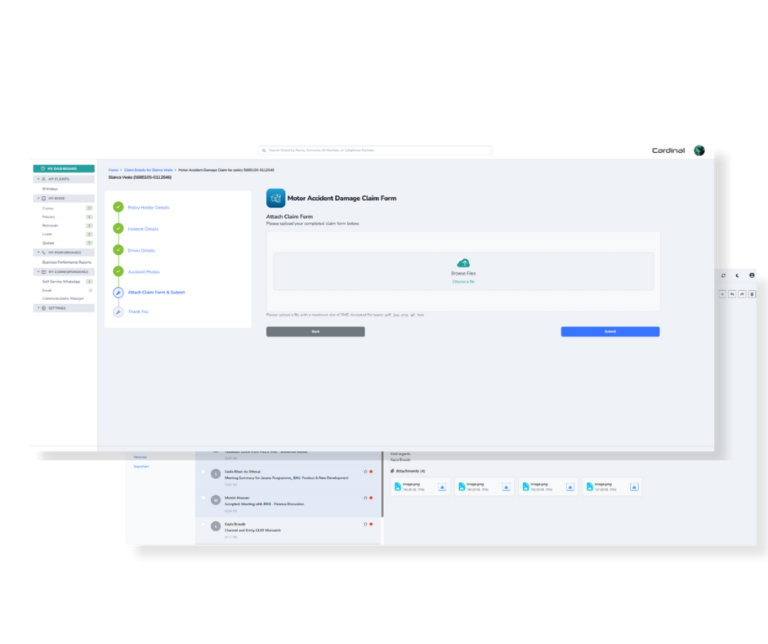

- Speed up claims processing and approvals with automation

- Connect legacy systems and modern platforms so everything works together

- Lower risk by using smart, consistent workflows that are easy to follow

Control →

- Gain clear visibility across claims, policies and customer touchpoints

- Make faster, data-driven decisions on underwriting and risk

- Scale operations without adding unnecessary complexity

Start Automating Where it's Most Profitable

Automate Field & Back Office + Compliance

Connect field and back office teams

Broker intake and quote setup

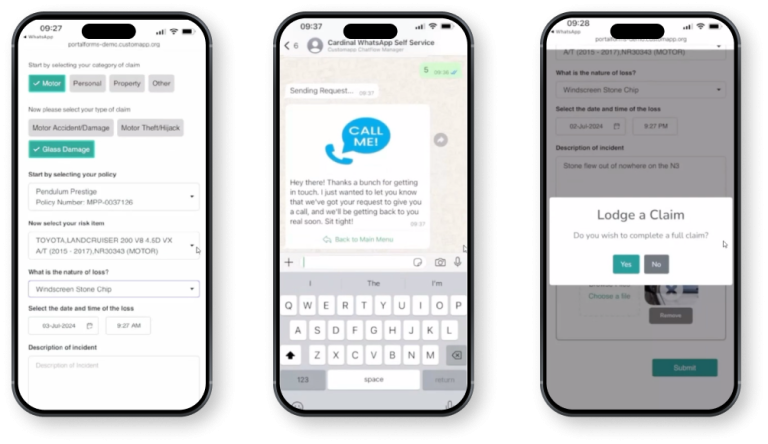

Claims initiation and documentation

Fleet and asset coordination

Data-driven dashboards & reporting

Operational Efficiencies + AI Automation

Policyholder onboarding and profiling

Risk assessment and underwriting

Renewals and cross-sell triggers

Compliance and audit reporting

Communication enablement & marketing channels

C Suite + Competitive Edge

Strategic Executive decision-making

Partner and ecosystem integration

Strategic advice & co-creation

Future-proofing the business

Customer Success Story

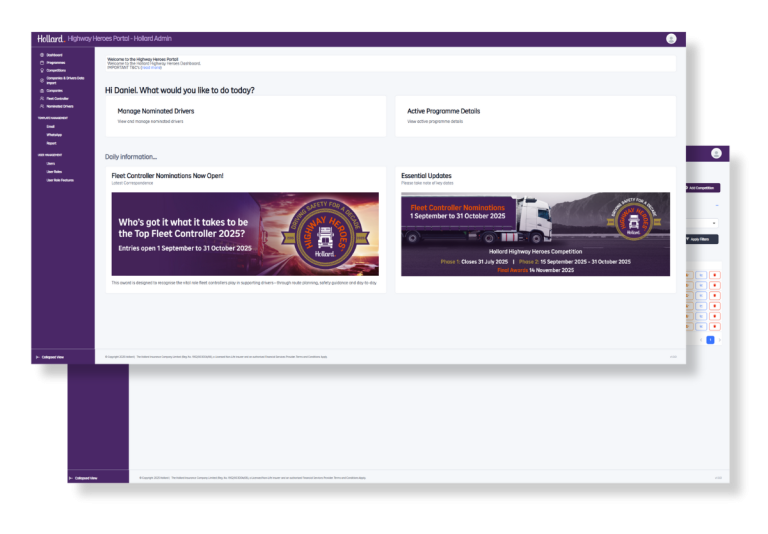

Hollard Highway Heroes

For 10 years, Hollard Highway Heroes, one of South Africa’s largest road-safety competitions, was managed through multiple, complex spreadsheets containing fleet company details, tracking providers, trucks, identification tags and thousands of driver records. With more than 300 fleet companies and 18,000 participating drivers, the programme had outgrown manual tools.

Key Pain Points

- Manual participant onboarding across multiple fleet owners and service providers

- Complex data management from various telematics sources without standardization

- Fragmented communication using traditional email and phone calls with poor engagement rates

- No real-time performance tracking or transparent leaderboards for 1800+ participating drivers

- Administrative burden requiring weeks to process competition data and determine winners

- Limited driver engagement between competition periods

- Inconsistent data quality from multiple fleet management systems

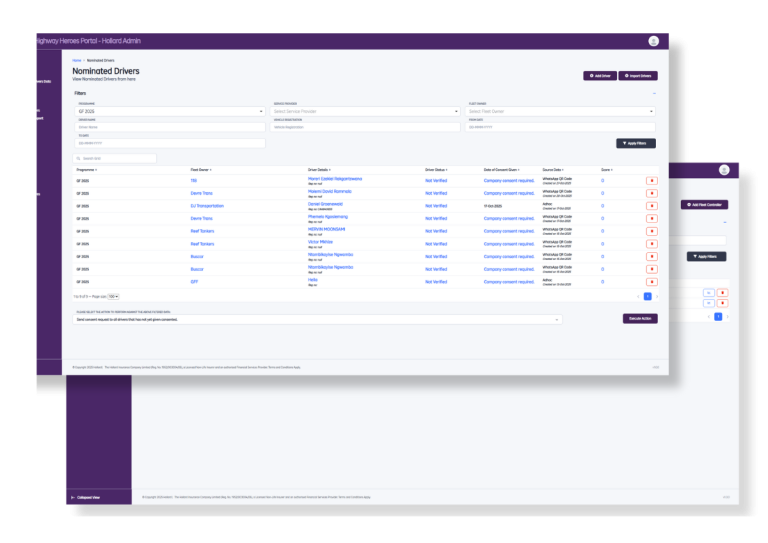

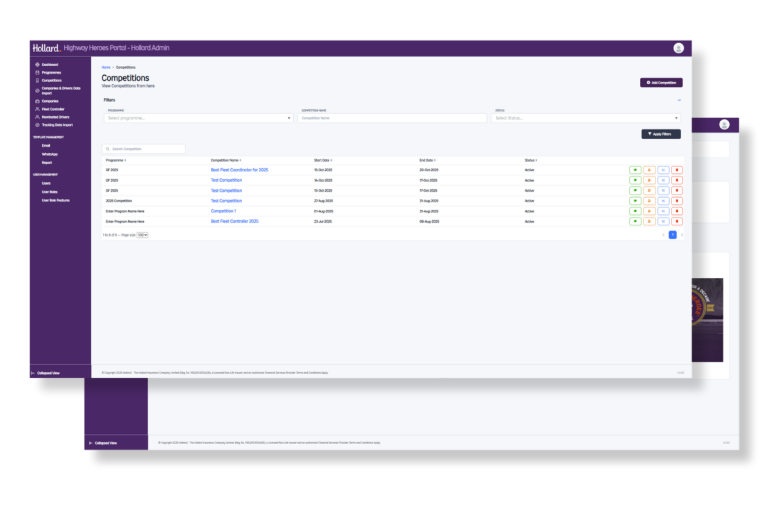

CustomApp replaced the entire manual process with a single, purpose-built digital platform that manages the Highway Heroes campaign end-to-end.

Through a central admin portal, Hollard can now set up and run competitions, import fleet companies and drivers in bulk, manage consent workflows, configure programmes and communicate directly with fleet owners and drivers.

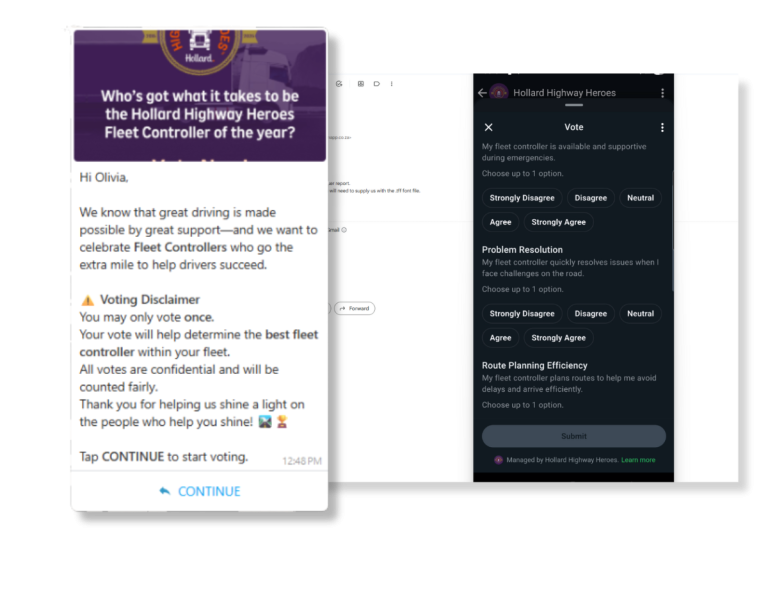

WhatsApp integration enables real-time updates, programme instructions and a fully digital voting process, including the Fleet Controller of the Year competition.

Dashboards give the team clear visibility of participation, voting activity and scoring, all without manual intervention.

The result is a unified system that simplifies programme setup, maintains clean and reliable data and supports consistent communication at national scale.

- Digital Onboarding & Communication

- Smart Participant Management System

- WhatsApp Business Integration

- Administrative Command Center

- Advanced Analytics & Performance Platform

- Telematics Data Intelligence

- Interactive Performance Dashboards

- Enhanced Communication Suite

- API-driven integrations for future scalability

Highway Heroes now runs on a streamlined digital foundation that supports growth, improves accuracy and makes it significantly easier for Hollard to manage a high-volume national competition.

- 65% faster onboarding

- 98% driver engagement

- 100% data automation

- 80% reduction in admin time

- 41% growth in driver participation

Self-Service Portals Purpose-Built for the Insurance Industry

WhatsApp Self Service Solution

Our WhatsApp Self-Service Solution turns a familiar channel into a high-performance service platform that simplifies interactions, automates routine processes and connects every part of your insurance operation in real time.

Broker Portal

Broker Portal is an all-in-one B2C and B2B client engagement platform that centralises everyday broker tasks, from accessing schedules to managing claims and communicating with clients, simplifying operations and reducing back-office pressure.

Turn Your Insurance Data into

Agentic AI Decision-making

Agentic AI Use Cases: Claims & FNOL

Streamline intake. Meet SLAs without chaos.

- Autonomously captures and verifies FNOL data (geo-tagging, policy match, document completeness)

- Predicts claim severity, flags potential fraud and assigns to the correct triage path

- Dynamically reorders claims queues based on SLA risk, complexity and bottlenecks

- Learns from prior exceptions to handle new edge cases without manual escalation

Agentic AI Use Cases: Fraud & Risk Management

Stop fraud in its tracks. Protect your margins in real time.

- Detects high-risk claim patterns using historical, behavioural and image data

- Automatically flags and routes suspicious cases for review or third-party investigation

- Continuously adapts fraud profiles using new inputs from location to supplier trends

Agentic AI Use Cases: Underwriting & Policy Management

Price smarter. Stay compliant. Grow profitably.

- Reassesses risk dynamically based on new IoT/telematics, life event, or geospatial data

- Suggests pricing or coverage adjustments for underperforming policy segments

- Monitors regulatory data for auto-triggered policy compliance reviews

Agentic AI Use Cases: Ops & Back Office

Forecast flawlessly. Eliminate process and audit headaches.

- Forecasts upcoming admin load and recommends resourcing or triage shifts

- Recommends optimisations to workflow steps that create bottlenecks

- Autocorrects or flags recurring form/data entry errors before they create audit issues

Agentic AI Use Cases: Broker & Field Enablement

Automate outreach. Boost conversions.

- Flags quote requests likely to convert, or require escalation based on need or profile

- Recommends follow-ups or reminders based on claim activity, doc gaps, or inactivity

- Suggests messaging tone and channel for client engagement based on risk/compliance profile

Agentic AI Use Cases: Customer Experience

Delight customers. Prevent complaints. Cut call-centre load.

- Predicts which claims or quote requests will escalate into complaints and messages first

- Drafts empathetic, human-toned updates on delays or policy changes

- Classifies incoming WhatsApp/email threads and reroutes intelligently, no call centre needed

How to De-Risk Your Next Transformation Project

Insurers are under pressure to modernise, but most “digital transformation” efforts end in delays, frustration and wasted spend.

How can you avoid that?

- Shared delivery risk: We commit alongside you because we back what we build

- Start small, prove fast: We often co-invest in a Proof of Concept to show impact early

Find out if your project qualifies for a free PoC.

Custom Support: The Backbone of Successful Digital Transformation

Easy Onboarding

Tailored onboarding for brokers, assessors, and back-office teams. Mapped to your claim types, triage flows and user journeys.

Sector-Specific Support Teams

Work with support teams trained on your scheme structures, regulatory obligations and supplier network.

Live Workflow Tuning

Hands-on assistance adjusting triage rules, routing flows, or SLA logic as your environment evolves and your solution scales.

Feedback That Fuels Your Platform’s Performance

Issues that impact your operation don’t just get logged; they inform product updates that help you reduce leakage, increase speed and stay in control at scale.

HOW TO GET STARTED

Hurts Most

Matters First

Already Use

You Grow

Not fluent in Tech?

Not a Problem

- Claims teams, call centre agents, assessors, anyone can use CustomApp’s tools without IT hand-holding or complex onboarding.

- Interfaces are intuitive, mobile-ready and built around how your teams work.

- Have an internal IT team? We integrate securely and cleanly with PAS, CRM and broker systems, without slowing down delivery.

Customer Support from Start to Finish & Beyond

- Capture claims, manage workflows, or escalate cases from anywhere, even with unstable connectivity. The system syncs when the signal returns.

- Receive guided onboarding and on-site support if needed.

- We stay connected, so your platform grows in tandem with your strategy.

Where Must Your Custom Solution Succeed?

Not sure what you need yet? That’s okay. Fill in what you can. Our team will take it from there.